Thailand Social Security Contribution Rate 2024

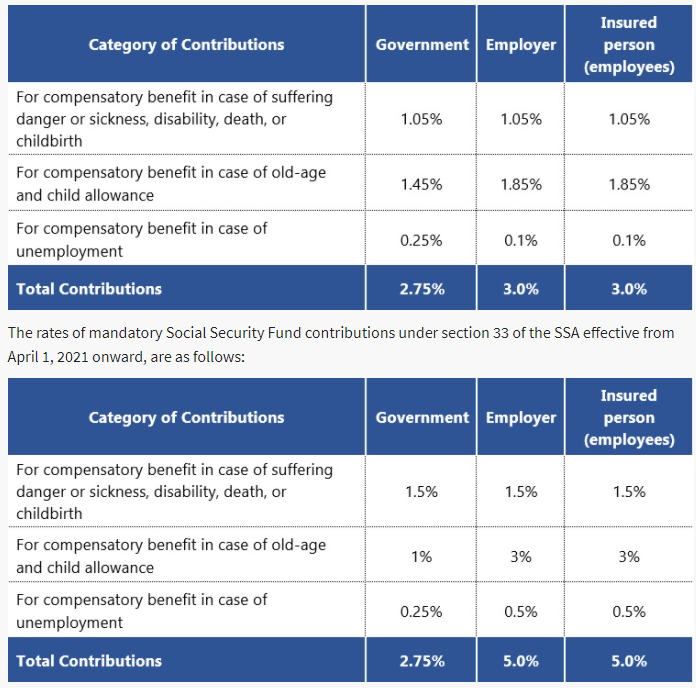

Thailand Social Security Contribution Rate 2024. Tax year employee rate employer rate combined rate; What is the social security contribution in thailand?

Mazars, thailand, ssf, payroll, royal gazette, social security office. Following these reductions, employee and employer’s contributions to social security have been adjusted to 3% of salary, with a maximum contribution of thb 450.

A New Notification From The Thai Government Will Introduce A Second Phase Of Reductions To Required Social Security Fund (Ssf) Contribution Rates.

From the of 1st october 2022 until the 31st december 2022, the social security rates will be as follows:

This New Measure, Once The Regulations Are Issued, Will Reduce The Monthly Contribution Rates Of Employers And Employees From 5% To 1% Of Wage Applicable For.

Social security rate for companies 5.00:

Under The Ministerial Regulation, The Rates For Social Security Fund Contributions Will Be Reduced From 5% To 1%, Based On Wages Being Capped At Thb 15,000, For Both.

Images References :

Source: www.lexology.com

Source: www.lexology.com

Thailand Announces Social Security Assistance for Second Wave of COVID, What are the new social security fund contribution rates? From 1 jan 2024 to 31 dec 2026, the contribution ceiling is 875 baht per month.

Source: www.belaws.com

Source: www.belaws.com

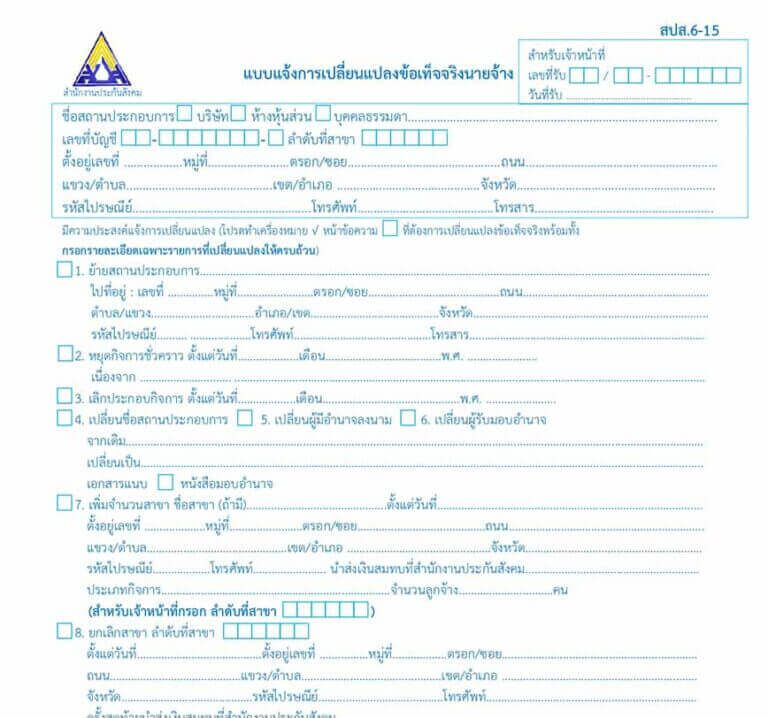

Thailand introduces new rates for Social Security Fund contributions, A fixed percentage of your monthly wages. From the of 1st october 2022 until the 31st december 2022, the social security rates will be as follows:

Source: www.belaws.com

Source: www.belaws.com

Thailand introduces new rates for Social Security Fund contributions, From the of 1st october 2022 until the 31st december 2022, the social security rates will be as follows: Social security rate for employees 5.00:

Source: magnacarta.co.th

Source: magnacarta.co.th

Thailand Social Security Fund Magna Carta Law Firm Pattaya, Phase one of social security fund. Contribution rates are calculated as a percentage of each employees' monthly wages, based on a minimum monthly wage of thb 1,650 and a maximum.

![Social Security Wage Base 2021 [Updated for 2023] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png) Source: www.uzio.com

Source: www.uzio.com

Social Security Wage Base 2021 [Updated for 2023] UZIO Inc, The reduced rates will be applicable for three months from 1 october 2022 to 31 december 2022. The thai cabinet decided today (tuesday) to allow employees to reduce their financial contributions to the social security scheme.

Source: www.belaws.com

Source: www.belaws.com

Thailand introduces new rates for Social Security Fund contributions, This new measure, once the regulations are issued, will reduce the monthly contribution rates of employers and employees from 5% to 1% of wage applicable for. What are the new social security fund contribution rates?

Source: jacyntheleffler.blogspot.com

Source: jacyntheleffler.blogspot.com

Socso Contribution Table 2020 Socso New Avanzo Management Consulting, What are the new social security fund contribution rates? Contribution rates are calculated as a percentage of each employees' monthly wages, based on a minimum monthly wage of thb 1,650 and a maximum.

Source: www.sanpedrosun.com

Source: www.sanpedrosun.com

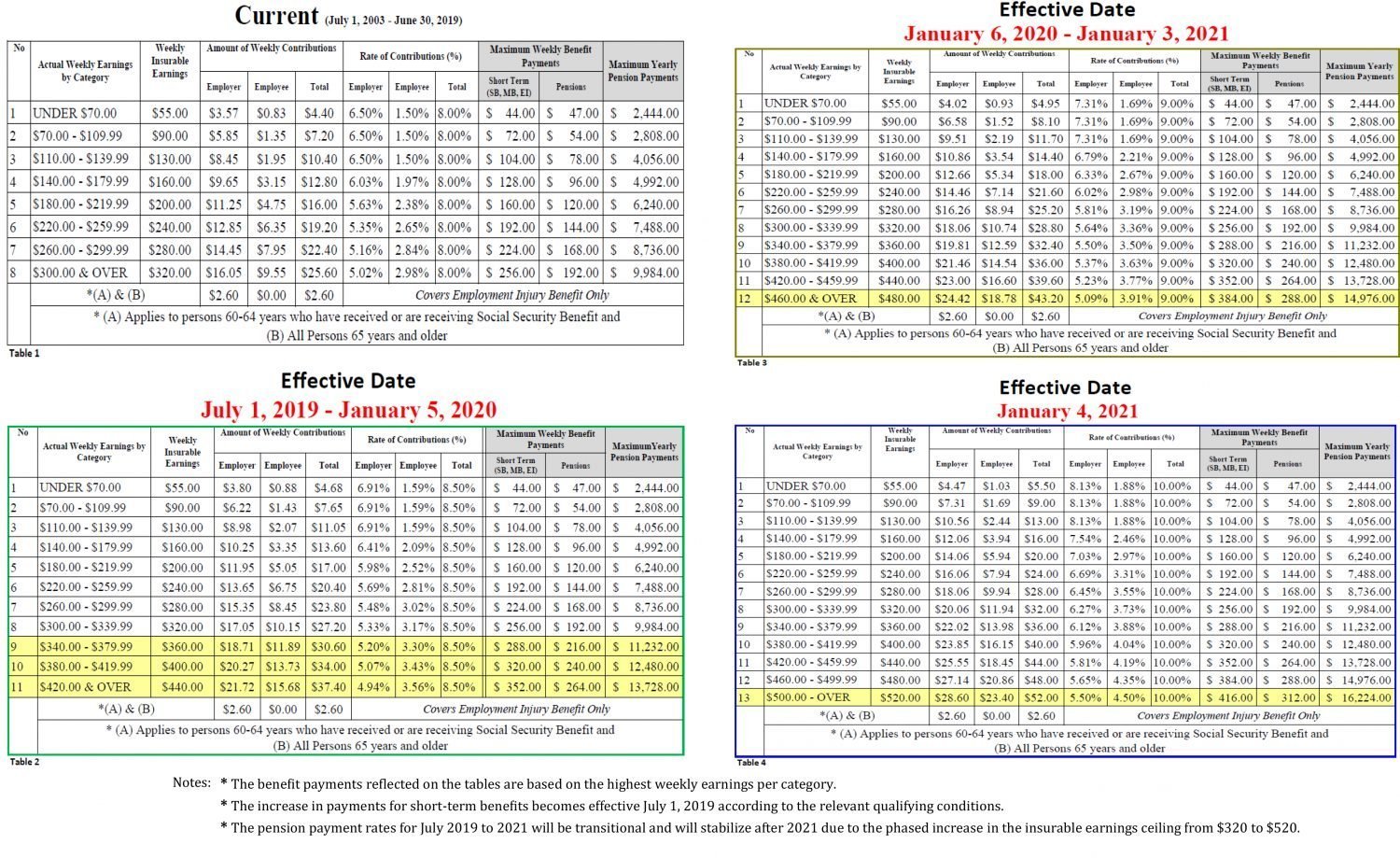

GOB approves Social Security Contribution Reform Contribution rate to, Phase one of social security fund. The current contribution rate is 5% of the employee’s salary.

Source: thailand.themispartner.com

Source: thailand.themispartner.com

Social security in Thailand Outsource your Thailand accounting to Experts, The thai cabinet decided today (tuesday) to allow employees to reduce their financial contributions to the social security scheme. What are the new social security fund contribution rates?

Source: www.howtoquick.net

Source: www.howtoquick.net

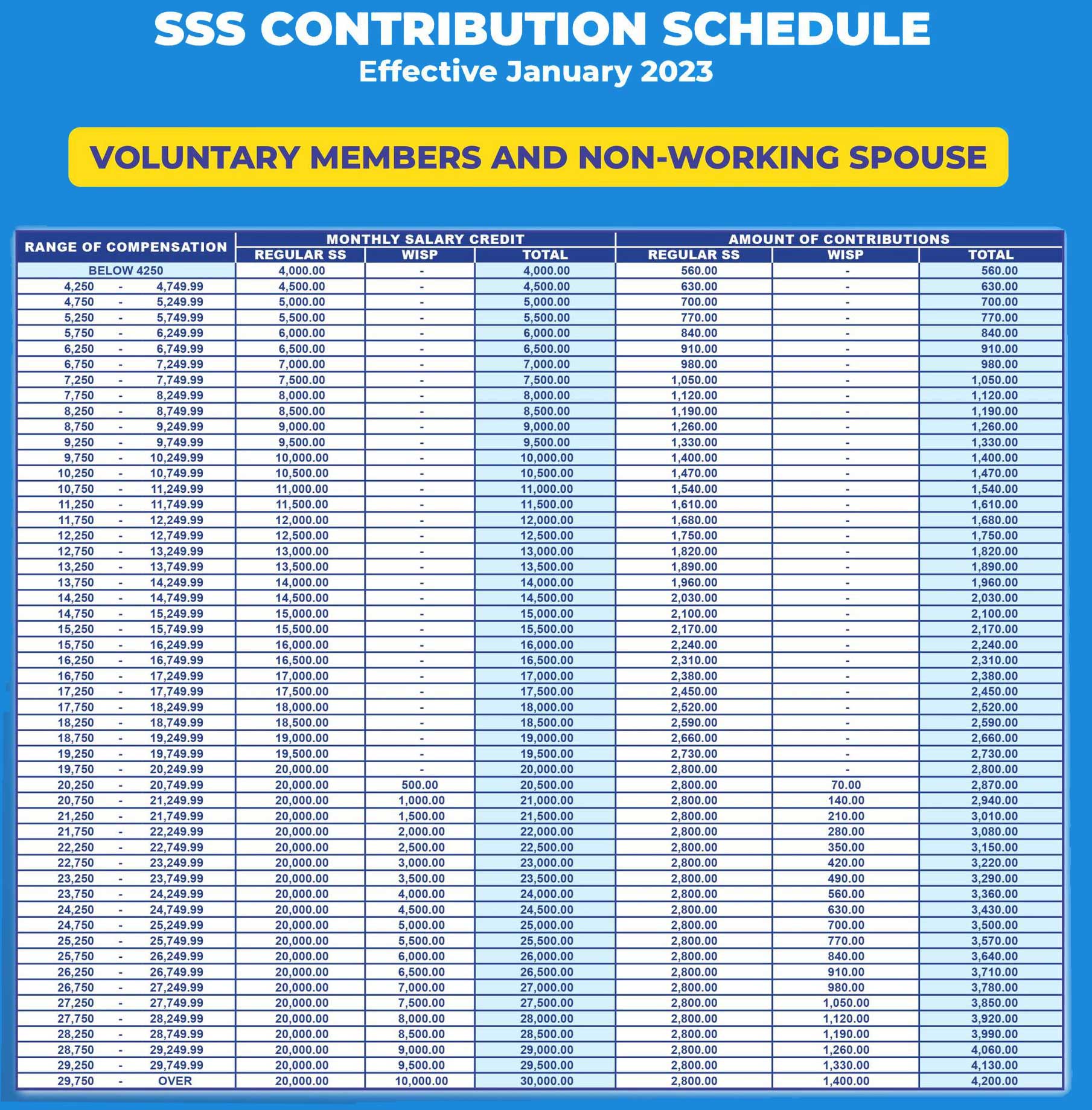

SSS Voluntary Members Contribution Table 2024, In thailand you are required to contribute 5% of your salary to the social security system, up to a maximum salary of 15,000 baht per month. The social security system operates on a contributory basis, meaning both the employee and the employer contribute a percentage of the employee’s wages to the social security fund.

This New Measure, Once The Regulations Are Issued, Will Reduce The Monthly Contribution Rates Of Employers And Employees From 5% To 1% Of Wage Applicable For.

2024 social security thresholds for thailand.

From 1 January 2023, The Rates Will Revert To The Original Rate Of 5%.

What are the new social security fund contribution rates?